Fortescue W. Hopkins

From THE PATRICK HENRY PAC(VA):

http://www.swva.net/politics/flat-tax (link expired)

Ladies and Gentlemen: State Legislators have the power(Art. V, U.S. Constitution) to reverse erroneous Supreme Court opinions granting improper, unlimited and unintended powers to Congressmen and to fulfill the prediction of James Madison that:

"*** the State legislatures will jealously and closely watch the operations of this Government, and be able to resist with more affect every assumption of power, than any other power on earth can do; and that the greatest opponents to a Federal Government admit the State Legislatures to be the sure guardians of the peoples liberty"

However, a leading opponent to ratification of the U.S. Constitution, Patrick Henry, did not agree. He predicted "a great consolidated government" and he said with reference to Art. V: "The way to amendment is shut" and "It is, sir, a most fearful situation, when the most contemptible minority can prevent the alteration of the most oppressive government". See Elliot's Debates, Vol III, J.P. Lippincott, pp49,50

To date, the States have never passed a U.S. Constitutional Amendment which they, alone, and not Congress proposed. Will they ever? Will the 9000+ State Legislators wake up and support HJRES 93, proposed by that true Patrick Henry Patriot, the Hon. Virgil H. Goode, Jr., a member of the US Congress from the fifth district of Virginia.

The New York Herald of March 19, 1861, wrote:

The new Constitution (of the Confederate States) is the Constitution of the United States with various modifications and some very important and most desirable improvements. We are free to say that the invaluable reforms enumerated therein should be adopted by the United States, with or without reunion of the seceded States, as soon as possible".

Among those important reforms were: The elimination of the General Welfare Clause, a line-item veto, a six year single term for the President, who could not be re-elected, and that "Every law, resolution have the force of law, shall relate to but one subject and that shall be expressed in the title" See the PROPOSED US CONSTITUTIONAL AMENDMENTS IN ORDER OF PRIORITY on the Home Page of The Patrick Henry Pac(VA).

Was it Alexis DeTocqueville who said: "The ever increasing power of a centralized authority will lead a race of men who would trample on kings to bend obsequiously to the dictates of a mere clerk"?

It is my hope, with the help of the Internet, that if the State Legislators do not get this message, the American people will and they will compel their State Legislators to act now.

Fortescue W. Hopkins, HC 34, Box 68, New Castle, VA 24127

A 77 year old retired Tax Lawyer. email: fhopkins@swva.net

SUMMARY OF THE FORTESCUE FLAT TAX:

By letter dated October 15,1984, I was advised by the Director of the Office of Tax Analysis, George N. Carlson, that: "Under your proposed(1984) pure flat rate tax with a broad uniform tax base(and no exemptions for the taxpayers or their dependents) a single rate of about 13% would generate the same level of individual income tax as the 1984 rate structure". By letter dated 1/17/96, I requested the Treasury Department's Office of Tax Analysis to determine the approximate rate of tax under the formula set forth in my Fortescue Flat Tax, revised on 1/15/96, as if it had been effective as of 1/1/95. To date, no response has been received to this request.

You can't BUY VOTES with the Fortescue Flat Tax(the"FFT") because it is totally PURE and NON-DISCRIMINATORY and is a US Constitutional Amendment that can't be changed overnite to satisfy some special interest. The "FFT" permits an individual election to get in or stay out of the Social Security System. If the election is to stay in the System , then a tax credit agains the FFT is allowed for Social Security Taxes paid. If the Election is to get out of the system, then a refund is made of total Social Security Taxes paid, less prior total Social Security payments to or for that individual and, also, a tax deduction of 10% of annual net savings placed in an IRA account is allowed for following years..

Under the FFT, the collection and determination of tax will be under the jurisdiction of State Authorities, with local trial by jury permitted and where what constitutes "NET INCOME" will be determined solely as a "MATTER OF FACT", with no regulations, precedent or presumption of correctness of a proposed tax liability permitted. The FFT will balance the budget and reduces the DEBT by 10% each year.

WAKE UP BELTWAY: THE INTERNET IS GOING TO CHANGE THE WORLD when it allows a 76 year OLD FOGIE, like me to broadcast to all America, at practically no expense, a MESSAGE that should and could change the HISTORY OF AMERICA.

Would PATRICK HENRY, if alive today, say:"TAXATION WITHOUT DISCRIMINATION"

Would JAMES MADISON, if alive today, say: "SEE, I TOLD YOU SO, THE STATE LEGISLATORS WILL PROTECT OUR RIGHTS UNDER THE BILL OF RIGHTS LIKE NO OTHER POWER ON EARTH".

What is wrong with this Country is certainly not POLITICIANS. Human Nature dictates that many will sell their vote to the highest bidder. The US Constitution and the US Supreme Court were designed and intended to protect our rights from abuse by Congress. However, only State Legislators, by Constitutional Amendment(ART. V) can correct and reverse the Supreme Court's erroneous expansion of the Commerce, Taxing and Spending powers of Congress. Recent meetings of State Governors suggest more activity on the part of States in controlling Congress.

NOW, will the State Legislators of every State who will look at my "HOME PAGE", which , also, contains VIRGINIA SENATE JOINT RESOLUTION NO.279, sponsored by that TRUE PATRIOT, Virginia Gentleman and State Senator, The Hon. VIRGIL H. GOODE, JR., finally WAKE UP and give some life to James Madison's famous prediction.

Most Sincerely and Hopefully,

Fortescue Whittle Hopkins, HC 34, Box 68, New Castle, VA 24127

2/6/96,540-864-5949,

Advise fhopkins@swva.net

PROPOSED US CONSTITUTIONAL AMENDMENTS OF THE PATRICK HENRY PAC(VA) IN ORDER OF PRIORITY

http://www.swva.net/politics/flat-tax/

AMENDMENT TO ARTICLE V.

(1) The Amendment proposed in House Joint Resolution 93, introduced by the Hon. Virgil H. Goode, Jr. on July 31, 1997, which provides that, if three fourths of the State Legislatures agree to a specific US. Constitutional amendment related to but one subject, then it is enacted without any action on the part of the US. Congress, thus avoiding any conceived possibility of a "runaway convention". See above WEB site for H.J.Res.93.

RELATED TO BUT ONE SUBJECT AND

REFERENCE TO ENUMERATED POWERS

(2) "Every law, or resolution having the force of law, shall relate to but one subject, and that, together with citation of the number of the enumerated power authorizing such law or resolution, shall be expressed in the title. All of the enumerated powers of Article 1, Section 8 shall be numbered consecutively. This Amendment shall become effective on January First of the year after the enactment of this Amendment."See Art.1,Sec.9,cl.20 of CSA Constitution.

ELIMINATION OF THE GENERAL WELFARE CLAUSE

(3) The first paragraph of Article I, Section 8 is amended (as in the Confederate Constitution, except for added italicized words) to read:

"Section 8. The Congress shall have power-

1. To lay and collect taxes, duties, imposts, and excises, for revenue necessary to pay the debts, provide for the common defense, and carry on the government of the United States; but no bounties shall be granted from the treasury; nor shall any duties or taxes on importations from foreign nations be laid to promote or foster any branch of industry; and all taxes, duties, imposts, and excises shall be uniform and non-discriminatory throughout the United States."

TAXATION WITHOUT DISCRIMINATION("TWD")

(4) "Neither Congress nor any State or political subdivision, thereof, shall make or continue any tax law, duty, impost, excise or other required payment that is, in the slightest degree, discriminatory or intended to achieve a non-revenue related objective, whether or not such discrimination or objective is authorized under the provisions of any constitution. This Amendment shall become effective on January First of the second year after the year of the enactment of this Amendment." On Discriminatory Taxation, read: "For Good and Evil", by Charles Adams and "The Hidden Welfare State", by Christopher Howard.

THE FORTESCUE FLAT TAX(THE "FFT")

THE TAX AND SPEND MAGNA CARTA

(5) The "FFT" eliminates all federal, state or local sales taxes. It is a non-discriminatory flat rate tax on net income determined as a matter of fact, not law. No exemptions, exclusions or credits permitted; collected locally to benefit local, state and federal governments. It balances the budget and reduces the federal debt by 10% per year. It gives individuals an option to get out of FICA taxes and contribute 10% to an IRA. For details, see WEB page, cited above..

YOUR COMMENTS ARE INVITED: Fortescue W. Hopkins, HC 34, Box 68, New Castle, VA, 24127,11/11/97, 540-864-5949, email: fhopkins@swva.net

THE PATRICK HENRY PAC(VA) A Virginia Political Action Committee

HC 34, Box 68, New Castle, VA 24127-9312

VA Reg. # 910498, 540-864-5949, Rev'd. 1/17/97

"TAXATION WITHOUT DISCRIMINATION"

THE TAX AND SPEND MAGNA CARTA

Section 1. The sixteenth article of amendment to the Constitution is hereby repealed.

Section 2. The fourth clause of Section 9 of Article I of the Constitution is hereby repealed and the third clause of Section 2 of Article 1 of the Constitution is hereby amended by eliminating the language "and direct taxes" contained therein.

Section 3. Except for the words "The Congress shall have Power", the first clause of Section 8 of Article I of the Constitution, including all legislation enacted pursuant thereto, is, hereby repealed effective as of the beginning of the calendar year following the adoption of this amendment and is replaced with the following language:

"Section 8. The Congress shall have Power To Lay an annual non-discriminatory, geographically and intrinsically uniform, flat rate income tax on the annual net income of all individuals in each of the several States, the District of Columbia and all Territories of the United States, only for the purpose of providing the revenue necessary to pay all debts heretofore incurred, to pay the costs of the Legislative, Executive and Judicial Branches of Government, as set forth in Articles I,II, and III of the Constitution and to carry out the powers specifically enumerated in this amendment and now expressly granted to Congress in Article 1, Section 8, Clauses 2 to 18, inclusive, of the Constitution, subject, however, to the following conditions:

A. "individuals" are defined to include all citizens of the United States and all non-citizens who have been residents of the United States for at least six months.

B. The "annual net income" of an individual is defined to include the receipt of anything of value, within one calendar year, from any and all sources, whatsoever, without exception, including interest received on obligations of any State or municipality therein, less cost(adjusted for annual inflation) or expenses related to any value received, less a carryover of any net loss from a prior tax year and shall be deemed to include the proportionate share of annual loss or the undistributed annual net income of any equity type entity(Corporation, Partnership, Trust,etc.) which elects not to pay an income tax (See Paragraph "J",infra,) and in which entity an individual has an equity interest; provided, however, that where bequests are involved, the individual beneficiary, will be entitled to deduct the decedent's cost basis, adjusted for inflation, in determining "individual annual net income".

C. The term "receipt of anything of value", shall be interpreted as broadly, as possible, and shall include, for example, the cost of any benefit to or expenditure made for the benefit of any individual, except between husband and wife, regardless of the source of such benefit or expenditure; provided, however, that the cost of reasonable educational, medical and living expenses provided to an individual who is physically disabled or under the age of 22, by a parent or grandparent shall not be deemed a "receipt of anything of value to that individual.

D. The "flat rate income tax", except as above provided, shall not, in the slightest degree, be discriminatory or intended to achieve a non-revenue related objective, whether or not such objective is otherwise permitted under this Constitution and no other exemptions, exclusions, tax credits or non-expense related deductions shall be permitted in computing "annual net income" and tax due thereon.

E. Each individual and/or parent or person with custody of a child under the age of 18 shall prepare and file on or before April 15 of each calendar year with the State , District or Territory of residence a one page income tax return disclosing "annual net income" for the preceding calendar year and report and pay such income tax as may be due to the Local Commissioner of Revenue or to such bank or agency as the State, District or Territory of residence may designate.

F. The local Commissioner of Revenue of each jurisdiction shall collect, determine and, if necessary, litigate any dispute concerning the correct amount of income tax due in the local civil and common-law court in the vicinity of the residence of the individual; provided, however, that no presumption of correctness will attach to the State's, District or Territories' determination of additional tax due and that the question of what constitutes a correct "annual net income" and/or "tax" will be determined as a "matter of fact" and not subject to any law or precedent and such individual will be entitled to a jury trial 1 with respect to any such dispute where the amount in controversy is at least $200.00.

G. Interest at a rate double the Federal discount rate will be payable on any late payment of income tax. The penalty for negligent failure to pay tax and/or negligent incorrect tax will be an additional 10% of the tax determined to be due. The penalty for willful failure and/or willfully false tax return shall be 100% of the tax ultimately determined to be due. On or before June 30th of each calendar year, each State, District or Territory shall remit to the United States Treasury all interest and income taxes collected ; but shall retain all penalties for its own use. .

H. On or before April 1 of each calendar year , the US Supreme Court shall establish the "flat rate" of this tax on individual annual net income in accordance with the following formula:

R = (X+Y) x 100/(Z) = ______%

WHERE:

X = Prior Calendar year's total Federal Expenditures. 2

Y = Ten Percent (10%) of the Total Federal Debt as of 12/31/ of the prior calendar year.

Z = Prior Calendar year's total Individual Annual Net Income 3

(Which for the first year, after the adoption of this amendment , will be an estimated amount)."

I. The Federal Government may maintain an agency to monitor the performance of the various States in the collection and the determination of this tax and if not satisfied with the performance of a certain State, it may file suit in the Federal courts to mandate a more reasonable compliance with this amendment and ask for an appropriate sanction 4 for the failure of any State to reasonably comply with its responsibilities under this amendment."

J. Equity type entities such as Corporations, Partnerships, Trusts, etc., that have equity holders shall be taxed as and subject to the same provisions as "individuals" under this amendment, except that they shall be allowed a deduction for all annual distributions to equity holders; provided, however, that: (1) In the case of equity holders residing in more than one State, District or Territory, they shall file an annual income tax return with and pay such taxes , as may be due, to the United States and that the legal jurisdiction to hear any dispute with respect to such taxes, shall, subject to the same conditions herein provided for "individuals", be in the United States District Court whose jurisdiction includes the principal office of the said equity type entity and that (2) All other equity type entities shall file an annual income tax return in the State, Territory or District in which is located the principal office of that entity, and, pay such income taxes as may be due to the Treasurer of that State, District or Territory and (3) Finally, all such entities may elect not to pay an annual income tax, in which event, they shall file a timely annual notice to each equity holder of the amount of annual loss or undistributed income allocable to that particular "individual".

K. As an exception to Section 3, above, the present Social Security and Medicare Tax(F.I.C.A.) and the Old Age, Survivors, and Disability, Insurance Tax(OASDI) will be allowed to continue indefinitely subject to the following conditions:

(a) The present Social Security and Medicare Tax System(F.I.C.A. and OASDI) will terminate with respect to all individuals, unless a then presently participating individual makes an irrevocable election to continue to participate under the F.I.C.A. or OASDI System, within six months of the effective date of this amendment.

(b) No withholding or payment of FICA tax will be required on the part of any employer. Whatever tax due will be paid directly by those individuals who elect to continue to participate under FICA and OASDI and payment shall be subject to the provisions of Paragraphs "F" and "G", above

(c) All individuals presently participating in and subject to the FICA and OASDI, who fail to make the election to continue to participate, as above provided, will be entitled to receive U.S. Treasury Bonds equal in amount to all prior contributions to his or her account plus interest at the prime rate, less benefits received.

(d) All benefits received by each individual under the FICA in excess of prior personal contributions will be taxable as currently taxable net income unless contributed within thirty(30) days to a personal IRA account.

(e) All individuals not participating in the FICA and OASDI Tax System will be entitled to a deduction from annual net taxable income equal to the amount of annual contributions of an Individual Retirement Account(I.R.A.) up to but not in excess of ten percent (10%) of annual net taxable income.

(f) In the formula for determining the "flat rate" as provided in Paragraph "H", above, the terms will include all Social Security and Medicare benefits paid as a "Federal Expenditure".

(End of proposed US Constitutional Amendment)

ARGUMENT IN SUPPORT OF THE FOREGOING PROPOSED AMENDMENT

As a separate amendment, it would also be appropriate to propose an additional amendment, as follows: "No State shall have the power to impose any form of Tax, Impost, Duty or Excise, except for a local non-discriminatory property tax and except for a flat rate individual income tax on "individual net income" as provided for the United States of America."

As you can see it is proposed to eliminate all Excise taxes(Federal & State), the reason being: (1) Indirect Excise Taxes do not promote Individual Political Responsibility and amount to a blank check which the politician uses to buy votes with and (2) Unfairly exacts from lower income persons a higher percentage of tax relative to income than from persons with higher incomes..

Also, all Federal duties and imposts are eliminated for the reason that an import duty to protect a farm or manufactured product, etc. is, in effect, an indirect tax on citizens that might otherwise pay less for a certain product.

Also, all Trade should be "FREE TRADE OR NO TRADE". There is no valid reason why we should not inform the rest of the world of this condition for trade with the largest and richest free trading area in the world, America. Again import duties do not promote "INDIVIDUAL POLITICAL RESPONSIBILITY" which is the indispensable "KEY" to "INDIVIDUAL ECONOMIC OPPORTUNITY".

As you will have noticed, this proposed amendment to Section 8, eliminates completely the General welfare clause which, of course, has been improperly construed by the Supreme Court to give Congress an unlimited power to spend, mandate and control. The Confederate Constitution eliminates the General Welfare Cl.

A Social Security Tax is, in fact, an unconstitutional highly discriminatory income tax against employees and self-employed and forces a person to contribute to an insurance program in which he has no vested interest, and where he may receive nothing if he dies early, all clearly in violation of the "takings" clause of the 5th Amendment and the 10th Amendment. Accordingly, Paragraph "K" provides that all individuals, except those who elect to be covered under the FICA, will be allowed a deduction up to ten percent(10%) of annual net income for investment in an Individual Retirement Account("IRA") Paragraph "K" has been prompted by the advice of Milton Friedman that you can not accomplish a totally non-discriminatory flat income tax in "one fell swoop" and by Articles in the Wall St. Journal. The Fortescue Flat Tax is the most synergistic with the Privatization of Social Security.

Also, this amendment eliminates corporate income taxes, but, instead, taxes the individual equity holder. Corporations do not pay taxes and do not vote. Only individuals do, so why tax corporations?

A completely non-discriminatory flat tax , without exclusions or exemptions is certainly equal and, most certainly, is what the framers of our Constitution intended when they used the word "UNIFORM". Our greatest Supreme Court Justice was

Stephen Field, who, with reference to a "$4,000.00 exclusion from taxable income said in Pollock v. Farmers Loan and Trust Co.(1895):

" Here I close my opinion. I could not say less in view of questions of such gravity that go down to the very foundation of the Government. If the provisions of the constitution can be set aside by an act of congress, where is the course of usurpation to end? The present assault upon capital is but the beginning. It will be but the stepping -stone to others, larger and more sweeping, till our political contests will become a war of the poor against the rich,-a war constantly growing in intensity and bitterness. "If the court sanctions the power of discriminating taxation and nullifies the uniformity mandate of the constitution," as said by one who has been a student all his life of our institutions, "it will surely mark the hour when the sure decadence of our present government will commence". If the purely arbitrary limitation of four thousand dollars in the present law can be sustained, none having less than that amount of income being assessed or taxed for support of the government, the limitation of future congresses, may be fixed at a much larger sum, at five or twenty thousand dollars, 5 parties possessing an income of that amount alone being bound to bear the burdens of government;"

The last few sentences of Walter K. Tuller's great book: "THE TAXING POWER/STATE INCOME TAXES(Callaghan & Co. 1937) bears repeating:

"IF THE COURTS PERMIT THOSE IN CONTROL OF THE EXECUTIVE AND LEGISLATIVE BRANCHES OF GOVERNMENT TO TAX WITHOUT DUE REGARD TO CONSTITUTIONAL LIMITATIONS,PARTICULARLY TO IMPOSE DISCRIMINATORY TAXES, CONSTITUTIONAL LIBERTY IS DEAD, WHATEVER FORMS MAY SURVIVE, THE GOVERNMENT WILL BE, IN FACT, ABSOLUTE. HERE LIES OUR GREATEST AND MOST IMMEDIATE DANGER. THE TIDE TODAY IS SETTING TOWARD THAT SHORE. THE ONLY HOPE LIES IN REVITALIZING THE OATH, SOLEMNLY TAKEN BY EVERY JUDGE OF EVERY COURT, TO MAINTAIN AND DEFEND THE CONSTITUTION OF THE UNITED STATES."

It is obvious to the undersigned that, as of 1995, the "tide has set" and that the most important question remains: WILL DICK ARMEY, BILL ARCHER OR ANYONE (except this PAC) EXPLAIN TO THE AMERICAN PEOPLE THE PROBLEM WITH AND THE SOLUTION TO "DISCRIMINATORY TAXATION" ?

When you read Henry Mayer's biography of Patrick Henry, "A SON OF THUNDER"(University Press of Virginia), it becomes quite clear that it was mostly the common people who backed the resistance to the Crown, and not the landed "aristocrats" who preferred the "status quo".

The "COLLECTIVIZATION" of America will continue unabated unless all "AMERICANS" are informed of and understand the dangers of the ever increasing power of the centralized government and are willing to act to compel State Legislators to curtail this power by the only possible means: "CONSTITUTIONAL AMENDMENTS", proposed and passed by the States. The recent "Williamsburg Resolves" suggests that many State Governors are willing to propose such action and to advise the American people. Lets support them.

As a member of Governor Allen's Advisory Council on Federalism, it is my advice to Governor Allen and to the members of this Council that: The present members of the Conference of the States (the "COS") and the members of this Council should publicly abandon all presently existing proposals designed to limit the powers of Congress and, instead, concentrate their efforts solely on persuading all of the other State Legislatures to adopt a resolution identical to SENATE JOINT RESOLUTION 279("SJR 279") which provides, in effect, that if 34 State legislatures agree to a specific U.S. Constitutional Amendment, related to but one subject, that amendment becomes part of the U.S. Constitution without any action required on the part of Congress.

SJR 279, a copy of which is attached hereto, was proposed by State Senator Virgil H. Goode, Jr., 112 N. Main St., Rocky Mount, VA 24151. ( 540-483-9030) and was agreed to unanimously by the Virginia House of Delegates on February 16, 1995 and , unanimously, by the Virginia Senate on February 20, 1995. Senator Goode is, also, a member of the Governor's Advisory Council on Federalism. Senator Goode is now Congressman Goode(1520 Longworth H.O.B.)

The foregoing proposed FLAT TAX amendment will be resisted as to complex and that "REDISTRIBUTION AND THE WELFARE STATE" should not be so hastily and completely eliminated. As a beginning, at least, the American people should act now to compel the following amendment:

THE TAX MAGNA CARTA

"THE CONGRESS SHALL ENACT NO TAX, DUTY, IMPOST, EXCISE, OR OTHER REQUIRED PAYMENT THAT IS, IN THE SLIGHTEST DEGREE, DISCRIMINATORY OR INTENDED TO ACHIEVE A NON-REVENUE RELATED OBJECTIVE, WHETHER OR NOT SUCH OBJECTIVE IS , OTHERWISE, PERMITTED UNDER THIS CONSTITUTION." 6

Whichever Presidential Candidate adopts this "TAXATION WITHOUT DISCRIMINATION" as his new "CONTRACT WITH AMERICA" and will advise America that you can't "BUY VOTES" with the "FORTESCUE FLAT TAX" will, automatically, become President of the United States.

Respectfully and hopefully submitted,

________________________________________

Fortescue W. Hopkins, Director,

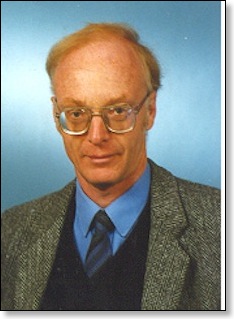

William fortescue (History)

SCHOOL OF HISTORY

Dr William Fortescue |

| Modules taught:

HI342 Revolutionary Movements in France and Russia

HI351 Nationalism and Nation States in Europe c.1780-1880

HI515 The Left and Right in Europe, 1870-1945

HI550/HI551 The Ancien Regime and the Revolution in France Research Interests: 19th- and 20th-century French history, particularly intellectual history and revolutionary movements. Currently researching France in 1848. Recent Publications: |

| The Third Republic in France 1870-1940: Conflicts & Continuities, Routledge, 2000. |

| Revolution and counter-revolution in France, 1815-1852, Oxford: Blackwell, 1988 [Translated into Portuguese (Sao Paulo: Martins Fontes, 1992)]. |

| 'Europe in revolt: the 1848 revolutions', in Europe, 1815-1870, edited by Peter Catterall and Richard Vinen, Oxford: Heinemann, 1994, pp. 50-58. |

| 'The Role of Women and Charity in the French Revolution of 1848: the Case of Marianne de Lamartine', French History, 11 (1997), 54-78. |

| 'Divorce debated and deferred: the French debate on divorce and the failure of the Crémieux divorce bill in 1848', French History, 7 (1993), 137-62. |

| 'French political culture and the 1848 revolution in France', History Review, no. 17 (1993), 30-34. |

| 'Europe in revolt: the 1848 revolutions', Modern History Review, 4 (1992), 22-25. |

(ukc.ac.uk)

Wine - Fortesque Simi (Curiosité)

Printtimainonnan harjoitustyö Primalco / Pembroke Valley ja Simi Fortesque

William M. Fortescue spool patent (Curiosité)

1901 FORTESCUE Darning Spool Patent 6710

The artwork is printed in black on archival quality acid-free 8 1/2" x 11" simulated parchment stock replicating the authentic look and feel of the original patent. The actual artwork image size varies according to the original document but your print can be readily cropped to fit an 8" x 10" display frame.

DESIGN.

No. . Patented Jan. 22 1901.

W. M. FORTESCUE.

DARNING SPOOL.

(Application filed Dec. 24 1900.)

471mrneys

UNITED STATES PATENT OFFICE.

WILLIAM M. FORTESCUE OF LEAVENWORTH KANSAS.

DESIGN FOR A DARNING-SPOOL.

SPECIFICATION forming part of Design No. dated. January 22 1901.

Application filed December 24 1900 aerial No. 40983. Term of patent 14 years.

To all whom it may concern:

Be it known that I WILLIAM M. FORTESCUE a citizen of the United States residing at Leavenworth in the county of Leavenworth

and State of Kansas have produced a new and original Design for a Darning-Spool of which the following is a specification.

This invention relates to a new and original design for a darning-spool and has for its object to provide a design of this character which shall be both useful and ornamental.

The invention consists in the design hereinafter described and shown in the drawings.

In the drawings Figure 1 is a side elevation of a darning-spool embodying the herein-described design. Figs. 2 and 3 are elevations of the respective ends thereof.

a general taper inwardly from the outer to the inner ends thereof. The cylindrical shank or spool portion 2 has opposite terminal and marginal circular flanges 3 and 4 which have their inner faces 5 and 6 respectively beveled inwardly to the cylindrical surface of the shank. The outer flange 3 is flush with the outer flat circular face of the shank which has a central circular opening 7 therein. The inner flange 4 lies at the intersection of the shank and the body and is slightly greater in diameter than the adjacent inner end of the body while the outer face of the flange is flat free from projections and forms an annular shoulder at the inner end of the body. Both flanges are of the same diameter and have flat outer marginal edges of equal widths. The

30 35 40 45

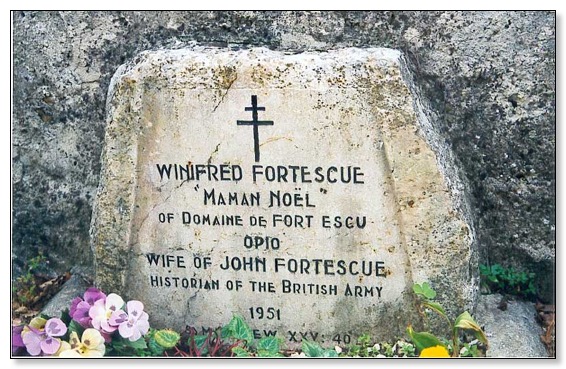

Lady Winifred Fortescue

All pictures from http://www.perfumefromprovence.com/Sunset.htm

Winifred & 'The Blackness' 1943

| Author, Actress, Fashion Designer & Interior Decorator pictured with her faithful companion 'The Blackness'. |

Winifred - 1926

Elisa, Edouard & Lady Fortescue collecting olives c1949

Winifred in the courtyard of Fort Escu in 1936

| In the early 1930's, John and Winifred Fortescue, now Sir John and Lady Fortescue, moved to Provence and there she wrote her famous and best selling |

In the early 1930s, Winifred Fortescue and her husband, Sir John Fortescue, left England and settled in Provence, in a small stone house amid olive groves, on the border of Grasse. Their exodus had been caused partly by ill health, but was mostly for financial reasons, as it was in the period between the wars when it was cheaper to live in France than in England.

Almost at once they were bewitched, by the scenery, by their garden - an incredible terraced landscape of vines, wild flowers, roses and lavender - and above all by the charming, infuriating, warm-hearted and wily Provencals. The house - called Domaine - was delightful but tiny, and at once plans were put in hand to extend it over the mountain terraces. Winifred Fortescue's witty and warm account of life with stonemasons, builders, craftsman, gardeners, and above all her total involvement with the everyday events of a Provencal village, made Perfume Of Provence an instant bestseller that went into several editions and became a famous and compulsive book for everyone who has ever loved France, most especially Provence.

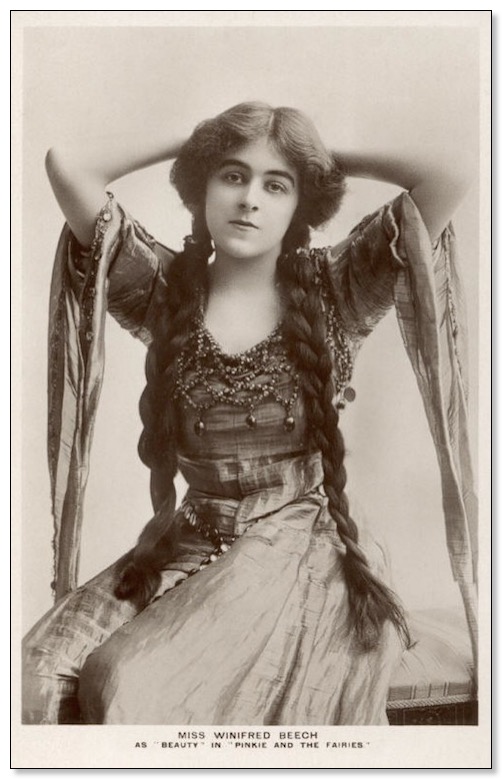

Winifred Fortesque was born in a Suffolk rectory on 7th February, 1888, the third child of a country rector and connected, on her mother's side, to the Fighting Battyes of India. She has written for Punch, Daily Chronicle, the Evening News and Morning Post. |

In the 1930s she moved to Provence with her husband. She died in Opio in April 1951.

Born |

![]()

https://www.npg.org.uk/collections/search/portrait/mw60820/Winifred-ne-Beech-Lady-Fortescue

Winifred (née Beech), Lady Fortescue

by Bassano Ltd

whole-plate glass negative, 20 August 1920

Given by Bassano & Vandyk Studios, 1974

Photographs Collection

NPG x75144

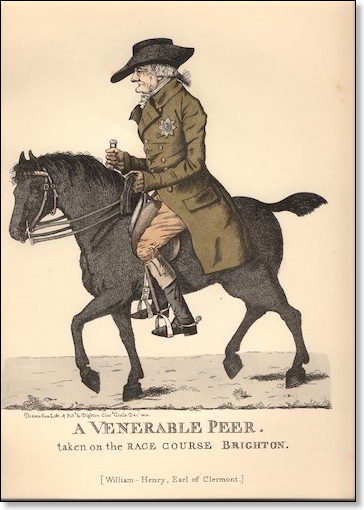

William Henry Fortescue 1rst Earl of Clermont - 1722-1806

Fortescue William Henry

1st Earl of Clermont - 1722 - 1806

William Banks Fortescue

Description: SPECTACULAR SCENERY OF LADY, original museum's quality oil on board ,very nice!!!

Signed: Signed with a monogram "FWB" and inscribed " william Banks/Fortescue" on the reverse (1850-1924), a well-listed British artist.

Age: The painting is from 20th century

Estimate: $4.000-5.000. No reserve auction.

Medium: Genuine oil on board.

Size: Without frame the item measures:

Width: 12,5 inches. (30 cm)

Height: 20 inches (40 cm.)

The frame is 4 inches (10 cm) wide.

INCLUDING THE FRAME IT MEASURES: W. 22 inches H.26 inches

---------------------------------------------------------

William Banks Fortescue

RA, RBA C.1855-1924

British Girl & Puppies,

Oil on canvas, signed

titled on reverse

---------------------------------------------------------![]()

430 - Illustrated -

William B. Fortesque. Whitewashed cottage interior with boy eating a pie,

and dog looking on, oil on canvas, signed, 13½ x 17½", glazed and in gilt frame

200/300

---------------------------------------------------------

Shelling Peas by William Banks Fortescue

Buy the picture here :

http://www.corbisimages.com/stock-photo/rights-managed/AALQ001070/shelling-peas-by-william-banks-fortescue![]()

.

.